The original premise of the City's 2005 Brownfields CIP was to provide a suite of tax-based benefits that "levelled the playing field" with respect to the redevelopment of Brownfield Sites compared with Greenfield Development. The key financial incentive components of the Brownfields Program are Tax Assistance and Rehabilitation Grants. The property Tax Assistance (referred to as the Brownfield Financial Tax Incentive Program, or BFTIP) includes the cancellation of both the municipal and education portions of the property taxes during the Assistance Period. The Rehabilitation Grants are based on the approved eligible Rehabilitation costs and are offered as financial incentives designed to promote the Rehabilitation and redevelopment of Brownfield Sites. For the purposes of the 2017 Brownfields CIP, the grants operate similar to a rebate. All fees and annual property taxes must be paid in full, and then the grant(s) will be paid back to the Property Owner in accordance with the details of the Brownfields Program as outlined in this CIP.

The financial incentive components of the Brownfields Program will be administered by the City and are intended, subject to Council's direction and existing approvals and brownfield site agreements, to be available indefinitely with the following exceptions:

- For approved brownfield properties at 51-57 Queen Street, 18 Queen Street and 282 Ontario Street: The grants may be paid out over a 10-year period for each brownfield site agreement approval that may run until December 31, 2041, or until all approved eligible Rehabilitation Costs have been recovered by the property owner, whichever comes first

- For CIPA 5: The grants may be paid out over a 10-year period for each brownfield site agreement approval that may run until December 31, 2038, or until all approved eligible Rehabilitation Costs have been recovered by the property owner, whichever comes first.

- For CIPA 6: Applications may be accepted until December 31, 2035. The grants may be paid out over a 10-year period for each brownfield site agreement approval that may run as late as December 31, 2045, or until all approved eligible Rehabilitation Costs have been recovered by the property owner, whichever occurs first.

It is specifically noted that the maximum amount of Tax Assistance and Rehabilitation Grants cannot exceed the approved eligible costs of site Rehabilitation. As a result, the approved eligible Rehabilitation costs (refer to Section 6.4) are a central component of the Brownfields Program and are key to the amounts of the Tax Assistance and/or Rehabilitation Grant that may be available. It should be noted that each application for one of the financial incentive components will be considered on its own merits and all properties may not be eligible for 100% of the financial incentives offered. Prior to the issuance of any Rehabilitation Grant payments, the Eligible Property must be rehabilitated in accordance with the applicable provincial legislation, regulations and guidelines and, where required by law, a Record of Site Condition (RSC) must be submitted to the Ministry of the Environment and Climate Change (MOECC).

The financial incentive components of the Brownfields Program are directed at the private sector and are designed to encourage private sector investment and reinvestment, development, and construction activity on contaminated properties and within contaminated buildings in the Community Improvement Project Areas (CIPA). As such, properties within a CIPA that are owned, or that were owned within the previous 10 years (from the date of submission of an application for the City's Brownfields Program), by an upper level of government, their agencies or crown corporations, are not eligible for funding under the Brownfields Program.

6.1 Brownfields Program and the Planning Process

The City's former Development Charge and Impost Fee Bylaws previously included provisions that allowed the City to provide exemptions to the charges and fees for properties that are within the designated "Community Improvement Area" as shown on Schedule 10 of the Official Plan and that are subject to an approved Community Improvement Plan.

Although the 2005 Brownfields CIP recognized these exemptions as a complement to the financial incentive components of the Brownfields Program, other than for projects within CIPA 6, such exemptions are not included within the terms of the Brownfields Exemptions from Development Charges and Impost Fees will not be available to new Brownfield CIP applications.

In addition to the planning process and approvals, there is also the question of the Remedial Work Plan and the level of Contamination. The level of environmental standard attained for the site through the Remedial Work Plan has a direct bearing on the future land uses that may be permitted. These standards, and the land uses permitted, are set out in Ontario Regulation 153/04.

The land use limits imposed by the environmental standards affect both the planning process and the financial incentive components of the Brownfields Program. The range of land uses proposed for a site may not be feasible in light of the environmental constraints imposed on the site by past uses and practices. The eventual land use(s) permitted on the site have a direct bearing on the assessment value of the land and

therefore, the value of the Tax Assistance and Rehabilitation Grant components of the Brownfields Program.

An application for financial assistance through the Brownfields Program for a property located within any of the defined Community Improvement Project Areas (CIPA) of the CIP shall be reviewed on a site-specific basis. It is expected that most of the Brownfields Program applications will be processed in conjunction with a planning application(s). In the case of a request to create a new CIPA or expand an existing CIPA, the policies of Section 8.1 of this CIP also apply.

6.2 Administration of the Brownfields Program

6.2.1 Priority Focus of the Brownfields Program

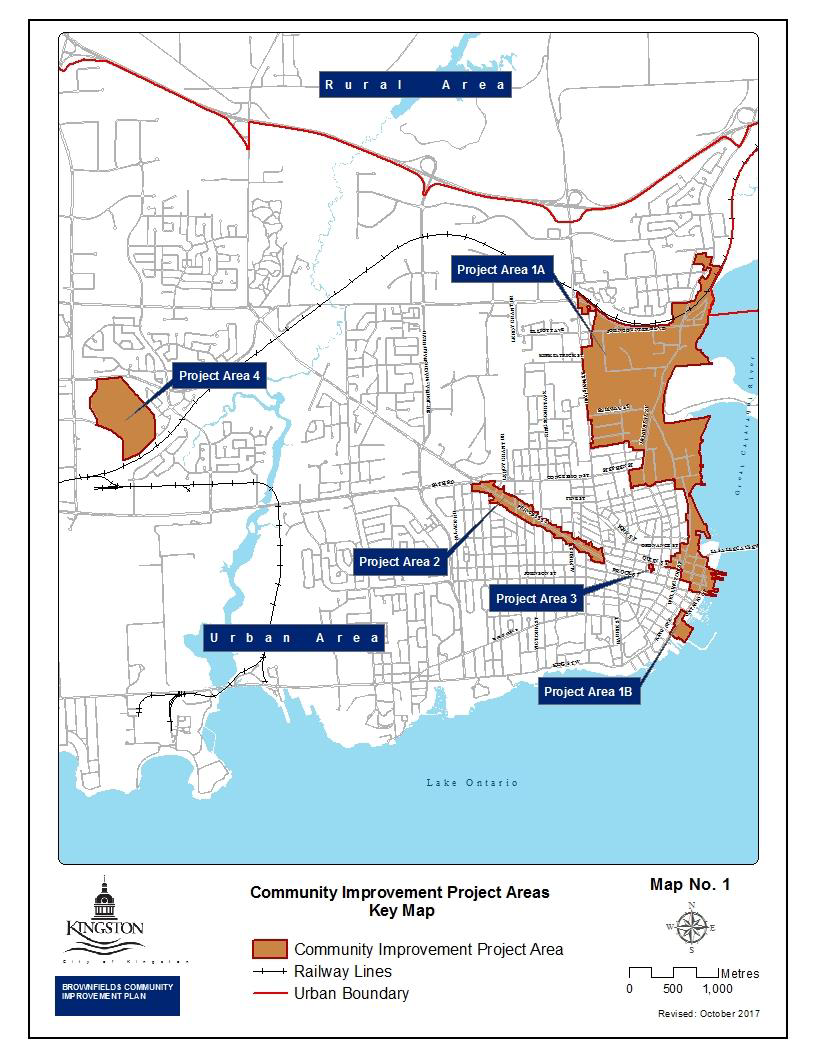

As noted in Section 5.1, CIPA 1A will be the priority focus for the financial incentive components of the Brownfields Program due to the history of industrial use in this area, the fact that it was one of the original CIPAs identified through the 2005 Brownfields CIP, and the fact that it still contains the greatest number of properties in the City with known or potential environmental encumbrances.

Due to the focus on CIPA 1A, sites within this project area will receive priority for financial incentives associated with the Brownfields Program. Consideration of an application for financial incentives for other properties, either for sites in existing CIPAs other than CIPA 1A or as part of a proposal to expand an existing CIPA or create a new one, will be at the sole discretion of the City. Properties will be evaluated by the City on a site-by-site basis using the following considerations:

- The submitted environmental studies have confirmed that the degree of site Contamination and encumbrance by other liabilities is extreme to the degree that Rehabilitation and redevelopment is clearly not feasible without financial assistance;

- The site is a "stigmatized" site, to the extent that the use or sale of the property, even if cleaned up, is unlikely to be successful, but the clean-up and redevelopment of which will likely act as a major catalyst for improvement/revitalization of the neighbourhood in which it is located;

- The site is causing major land use compatibility issues and is surrounded in whole or in part by residential or other sensitive land uses;

- The proposed project will attract significant private sector investment resulting in exceptional increases in property tax revenues, employment and/or residential opportunities;

- The proposed project will showcase innovative site Rehabilitation approaches, technologies or risk assessment approaches;

- The site is a failed tax sale property; acquired by the applicant through the City's Failed Tax Sale process; and/or

- The site, or liability for the site, is owned by the municipality and has been or will be divested in whole or in part to the applicant and significant Contamination or other encumbrances are present.

As noted in Section 5.2, as of the date of the approval of the 2017 Brownfields CIP, City will no longer be accepting applications for CIPA 2 for the Williamsville Main Street. The City will re-visit the issue of accepting applications for CIPA 2 within the context of the next Brownfields Program review.

6.2.2 Sliding Scale for Financial Incentives

Brownfield Sites can vary considerably in size, character, location and the degree of environmental Contamination. The City's ongoing monitoring of the Brownfields Program since 2005 has noted that some properties for which applications had been submitted were relatively less environmentally encumbered than other properties. Those properties were located within the Community Improvement Project Areas and redevelopment furthered the goals of the 2005 Brownfields CIP, as amended, with respect to site Rehabilitation, intensification and infill. However, it was recognized that properties with lesser degrees of environmental encumbrance may not require full application of the Brownfields Program benefits in order to achieve the objective to "level the playing field" between Brownfield Sites and Greenfield Development.

In June 2014, Council approved changes to the Brownfields Program, which authorized staff to enhance the administration of the Brownfields Program using a sliding scale approach to each eligible application so that the financial incentives would be proportional to:

- The degree of environmental encumbrance relative to the value of the proposed redevelopment project; and

- The area of the property that requires Rehabilitation as a percentage of the total property area.

In accordance with Council's direction to use the sliding scale approach, at the time of application for one of the financial incentive components of the Brownfields Program offered under this CIP, staff will review the following criteria to assess the level of financial incentive that may be recommended for approval:

- The property's relative degree of environmental encumbrance;

- The percentage of the total property area that requires Rehabilitation;

- Whether the property is or has been unused or underutilized for an extended period of time (greater than 5 years);

- Whether recent real property transactions may have already discounted the site's environmental liabilities; and

- Whether the recent or current Property Owner contributed to the Contamination and has liability for those actions and responsibility for clean-up.

6.3 General Program Requirements

The following is a list of general eligibility criteria and requirements applicable to all of the financial incentive components of the Brownfields Program:

- With the exception of the Phase II Environmental Site Assessment, Remedial Action Plan, and/or Site Specific Risk Assessment costs not covered by the Initial Study Grant, the financial incentive components of the Brownfields Program are not offered retroactively. Only those Rehabilitation or development activities or costs incurred after the date of approval of the 2017 Brownfields CIP, or after the effective date of any approved amendments to the 2017 Brownfields CIP (including amendments to the Community Improvement Project Areas), will be eligible for funding.

- The total of all Rehabilitation Grants and Tax Assistance provided in respect of an Eligible Property under the financial incentive components of the Brownfields Program cannot exceed the total of the approved eligible Rehabilitation costs with respect to that property or building.

- Although eligible Rehabilitation costs may be applicable to more than one of the financial incentive components of the Brownfields Program offered through this no two components can be used to repay the same cost. Also, where other sources of government and/or non-profit organization funding (federal, provincial, municipal, Federation of Canadian Municipalities, etc.) are anticipated or have been secured, these must be declared on the applicable application(s) and cannot be used to reimburse the same costs.

- Eligible Properties must be located in a Community Improvement Project Area.

- Properties within a Community Improvement Project Area that are owned, or that were owned within the previous 10 years (from the date of submission of an application for the City's Brownfields Program), by an upper level of government, their agencies or crown corporations, are not eligible for funding under the Brownfields Program. This exclusion does not apply to the property at 5 Lower Union Street.

- The recent or current Property Owner cannot be responsible for causing the on-site Contamination that requires Rehabilitation.

- The City reserves the right to audit the cost of project feasibility studies, environmental studies, and/or environmental Rehabilitation works that have been approved under the financial incentive components of the Brownfields Program, at the expense of the Property Owner.

- The City is not responsible for any costs incurred by the Property Owner in relation to any of the financial incentive components of the Brownfields Program, including without limitation, costs incurred in anticipation of receipt of a Rehabilitation Grant and/or Tax Assistance.

- City staff, officials, and/or agents of the City may inspect any property that is the subject of an application for any of the financial incentive components of the Brownfields Program.

- If the Property Owner is in default of any of the general or program specific requirements, or any other requirements of the City, the City may delay, reduce or cancel the approved Rehabilitation Grant and/or Tax Assistance.

- The City may discontinue any of the financial incentive components of the Brownfields Program at any time and at its sole discretion, but Property Owners with approved Rehabilitation Grants and/or Tax Assistance will still receive said Rehabilitation Grant and/or Tax Assistance, subject to conformity with the applicable general and program specific requirements of this CIP.

- Eligible Properties for the BFTIP and/or TIRGP must have a Phase II Environmental Site Assessment (ESA) completed that indicates environmental Rehabilitation of lands or buildings is required to obtain a Record of Site Condition (RSC) to allow a change to a more sensitive land use, or to enable the proposed redevelopment where a RSC is not required by provincial law. Only properties that are contaminated with respect to Ministry of the Environment and Climate Change standards as to the proposed use of the property will be eligible for the financial incentive components of the Brownfields Program. The Property Owner shall release all environmental information about an Eligible Property to the City.

- Outstanding work orders, and/or orders or requests to comply issued by the City or Utilities Kingston, and/or other charges from the City (including any tax arrears and local improvement charges) must be satisfactorily addressed prior to the payment of any Rehabilitation Grant or Tax Assistance.

- Only the Property Owner of an Eligible Property can apply for and receive the Tax Assistance and/or Rehabilitation Grant. Written authorization shall be required from the Property Owner for any agent acting on their behalf.

- Property Owners shall declare if the subject property is designated under Part IV or Part V of the Ontario Heritage Act, or is adjacent to a property that is designated under the Ontario Heritage Act.

- The Property Owner or their agent shall submit the applicable completed application(s) with the required supporting documentation, including a development proposal and concept plan for the Eligible Property. Only complete applications will be processed.

- Property Owners for the BFTIP and/or TIRGP will be required to enter into a Brownfield Site Agreement with the City that will specify the terms and conditions Council's approval of any of the financial incentive components of the Brownfields Program, the relevant conditions of any associated planning and/or environmental approvals, and the specifics of the property Tax Assistance and/or Rehabilitation Grant to be received.

- Proposed developments or redevelopments that will result in uses that are completely or partially exempt from payment of municipal property taxes are not eligible for the financial incentive components of the Brownfields Program of this CIP.

- Each application will be considered on its own merits and may not be eligible for 100% of the benefits offered under the financial incentive components of the Brownfields Program.

6.4 Eligible Rehabilitation Costs

The eligible costs required to rehabilitate an Eligible Property are central to the financial incentive components of the Brownfields Program of this CIP. These items all relate to the environmental Rehabilitation of the property and the implementation of the Remedial Action Plan. The eligible Rehabilitation costs include the following:

- Up to 100% of the cost of environmental Rehabilitation: The eligible Rehabilitation costs shall only include those costs incurred over and above normal construction work, due to environmental contaminants that must be removed or managed in order to achieve the provincial soil, groundwater or sediment standards required for a Record of Site Condition;

- Up to 100% of the costs of placing clean fill and grading in the areas where excavation was required for site Rehabilitation: The eligible costs for placement of clean fill and grading shall only include those costs incurred over and above normal construction work, due to environmental contaminants that must be removed or managed in order to achieve the provincial soil, groundwater or sediment standards required for a Record of Site Condition;

- Up to to 100% of the cost of a Phase II Environmental Site Assessment, Remedial Plan, and/or Site Specific Risk Assessments not covered by the Initial Study or other sources of government or non-profit funding;

- Up to 100% of the cost of preparing a Record of Site Condition (RSC);

- Up to 100% of the cost of demolishing abandoned, underutilized or derelict buildings on the property;

- Up to 100% of the cost of establishing an Environmental Monitoring Program, and the cost of operating and maintaining the environmental technologies, where said technologies are directly related to the Rehabilitation of the site, as specified in the Remedial Action Plan and Certificate of Property Use (CPU). The cost may be based on either the present value of future costs or the pro-rated costs, for a maximum period of twenty (20) years; and

- Up to 100% of the cost, or the shared portion of the cost, of the following Leadership in Energy and Environmental Design (LEED) Program components:

- Fees paid to the Canada Green Building Council (CaGBC) for registration of the project within any of the LEED rating systems supported by the CaGBC; and,

- Fees paid to the Canada Green Building Council (CaGBC) for certification of the project within any of the LEED rating systems supported by the CaGBC.

6.5 Initial Study Grant (ISG)

6.5.1 Purpose

The purpose of the Initial Study Grant (ISG) is to promote the undertaking of environmental studies that result in a more complete understanding with respect to the type, concentration and location of Contamination that exists on a Brownfield Site, the potential costs of Rehabilitation, and development of a plan to remove, treat or otherwise manage the Contamination found on the property. This will also assist the Property Owner in acquiring the environmental information needed to determine if the property will be eligible for other financial incentive components of the Brownfields Program.

6.5.2 Duration

There is no specified end date for receiving applications for Initial Study Grants. However, Council may opt to end the offering of this component of the Brownfields Program at any time.

6.5.3 Eligible Properties

Only properties located in a Community Improvement Project Area are eligible to apply for an ISG.

6.5.4 Grant Requirements

Property Owners or their agents are eligible to apply for funding under the ISG, subject to meeting the General Program Requirements set out in Section 6.3 of this CIP, the requirements outlined in this Section 6.5, and the availability of funding as approved by Council. Further details with respect to eligibility requirements are contained in the "Initial Study Grant Implementation Guide".

A Phase I ESA does not provide detailed information with respect to the type of Contamination and the costs of site Rehabilitation, therefore Phase I ESAs are not eligible for funding under the ISG Program. To be eligible to apply for an ISG, a Phase I Environmental Site Assessment (ESA) must have been completed on the property and must show that the property is suspected to be contaminated.

6.5.5 Grant Description

The ISG will provide a matching grant of 50% of the cost of eligible environmental studies to a maximum total grant of $20,000 and two studies per property or

Eligible studies include:

- Phase II Environmental Site Assessment (ESA);

- Remedial Action Plans; and

- Site-Specific Risk Assessment (SSRA).

The foregoing studies shall be for the purposes of:

- confirming and describing Contamination on the property; and/or

- surveying designated substances and hazardous materials on the property; and/or

- developing a plan to remove, treat or otherwise manage the Contamination found on the property.

An ISG will only be offered on Eligible Properties where there is the potential for Rehabilitation and/or redevelopment of the property.

6.5.6 Application Process

Applications will be processed and approved subject to the availability of funding as approved by Council. Only complete applications will be processed. An ISG application may be submitted in advance of any other Brownfields Program application(s) being filed or filed concurrently with any other application(s). ISG applications must include a detailed study work plan, a cost estimate for the study, and a description of the planned development, including any planning applications that have been submitted and/or approved. Where other sources of funding for the conduct of environmental studies are anticipated or have been secured, these must be declared as part of the ISG application. Further details with respect to the application requirements and process are contained in the "Initial Study Grant Implementation Guide".

Review and evaluation of an application and supporting materials against the ISG Program eligibility requirements will be undertaken by the Real Estate & Environmental Initiatives Department. A staff report will be prepared for submission to Council with a recommendation to approve or reject the ISG application. The Property Owner will be notified in writing of Council's decision. If Council approves the application, an Initial Study Grant Bylaw will be passed confirming the approval and outlining any associated conditions for the ISG.

6.5.7 Initial Study Grant Bylaw

The Initial Study Grant Bylaw sets out the terms of the grant including, but not limited to, the following:

- the total funding to be granted to the Property Owner for the preparation of the study or studies;

- a clear description of the final study product;

- the conditions and schedule for the release of the ISG funds to the Property Owner; and,

- the administrative submissions required from the Property Owner or their agent regarding completion of the study or studies and proof of invoicing, billing and payments.

6.5.8 Grant Payments

Grants approved under the ISG component of the Brownfields Program will be provided to the Property Owner following submission and City review of the final completed study together with the original invoice confirming that the study consultants have been paid in full. The Property Owner or their agent shall submit one electronic copy and one hard copy of all studies to the City. The Property Owner shall also provide the City with permission to circulate the studies to internal City departments, and to advise other project proponents that a study or studies exist. However, the study or studies will not released by the City, unless required by law.

The ISG amount will be the lesser of the cost estimate provided by the consultant conducting the study or the actual cost of the study. The ISG may be reduced or cancelled if the study is not completed, not completed as approved, or if the consultant that conducted the study is not paid. The ISG will lapse if not claimed within two years of the approval of the application, unless a request for an extension is submitted in writing and approved prior to the grant lapsing.

6.5.9 Grant is Not Retroactive

The ISG is not offered retroactively for any study undertaken, or costs incurred, prior to the Property Owner receiving Council approval for the ISG.

6.6 Brownfields Financial Tax Incentive Program (BFTIP)

6.6.1

The purpose of the BFTIP (Tax Assistance) is to encourage private sector Rehabilitation of Brownfield Sites for future redevelopment purposes by cancelling all or a portion of the municipal property taxes to offset the approved eligible Rehabilitation costs incurred by the Property Owner.

6.6.2 BFTIP Duration

Except for end dates described within Section 6.0 and the provincial rules for education tax cancellations under the BFTIP, there are no specified end dates for approval of applications or cancellations related to the BFTIP program. However, Council may opt end the offering of this component of the Brownfields Program at any time.

6.6.3 Eligible Properties

An Eligible Property for the BFTIP must be located in a Community Improvement Project Area. The property must have an approved Phase II Environmental Site Assessment that, as of the date the Phase II ESA was completed, confirmed that the property was contaminated and did not meet the standards of the Environmental Protection Act to permit a Record of Site Condition to be filed in the Environmental Site Registry.

6.6.4 BFTIP Requirements

Property Owners or their agents are eligible to apply for funding under the BFTIP, subject to meeting the General Program Requirements set out in Section 6.3 of this CIP and the requirements outlined in this Section 6.6. Further details with respect to eligibility requirements are contained in the "BFTIP and TIRGP Implementation Guide".

6.6.5 BFTIP Description

The BFTIP allows for the cancellation of up to 100% of municipal property taxes. Tax Assistance will only apply during the Assistance Period of the project in accordance with the provisions of the Municipal Act, 2001. The maximum Tax Assistance available shall be equal to or less than the total of the approved eligible Rehabilitation costs (refer to Section 6.4 for a description of the eligible costs). The municipal portion of the property Tax Assistance will terminate when the total Tax Assistance provided (municipal and education) equals the total approved Rehabilitation costs, OR, on the date that the Assistance Period ends (refer to Appendix A for definition), OR such earlier period otherwise stipulated in the Tax Assistance Bylaw.

The Minister of Finance may match the municipality's BFTIP Tax Assistance through the cancellation of the education portion of the property tax. This exemption may run concurrently with the Assistance Period. The education portion of the property Tax Assistance will terminate when the total Tax Assistance provided (municipal and education) equals the total approved eligible Rehabilitation costs, OR after ten years (for residential developments), OR after six years (for business developments), OR such earlier period otherwise stipulated in the Tax Assistance Bylaw. The education portion of the Tax Assistance will also terminate if the property approved for Tax Assistance is severed, subdivided, sold or conveyed. Any conditions imposed by the Minister of Finance with respect to the cancellation of the education portion of the property tax will be included in the Tax Assistance Bylaw.

In accordance with the provisions of the Municipal Act, 2001, Tax Assistance will be suspended where the Property Owner has not paid all of the taxes for the previous years during the Rehabilitation and Development Periods (subject to any specific exceptions provided for in the Tax Assistance Bylaw or in the Brownfield Site Agreement). Where

the Property Owner defaults on the provisions of the Tax Assistance Bylaw or the Brownfield Site Agreement, all Tax Assistance granted during the Rehabilitation and Development Periods will become due for repayment in full, with interest.

6.6.6 Application Process

Applications will be processed and approved on a first come, first served basis. Property Owners and their agents should pre-consult with the City to confirm BFTIP eligibility. Applications for the BFTIP may be filed concurrently with applications for one or more of the other financial incentive components of the Brownfields Program, as outlined in this CIP, and must include, among other matters:

- A description of the development concept, concept plans, total project construction value, phasing and timing, and a summary of any planning applications that have been submitted and their status;

- Details of any Initial Study Grant received;

- A detailed description of the eligible Rehabilitation works to be completed together with a cost estimate for each of the eligible works;

- The current property assessment and an estimate of future assessment based on the development proposal;

- Supporting technical studies and reports including Phase I or II ESA's and/or a SSRA; the Remedial Action Plan; the Rehabilitation approach under consideration (i.e. full-depth, stratified, or risk assessment); the Environmental Monitoring Program; and, any eligible LEED Program cost estimates.

The City, upon request from and on behalf of the Property Owner, will forward an application for matching educational Tax Assistance under the BFTIP to the Province for their review and consideration. Only complete BFTIP applications will be processed. Further details with respect to the application requirements and process are contained in the "BFTIP And TIRGP Implementation Guide. Review and evaluation of the BFTIP application and supporting materials against Program eligibility requirements will be undertaken by the Real Estate & Environmental Initiatives Department. The application may be circulated to other City departments for review and comment (e.g. Planning, Building & Licensing Services, Engineering, Utilities Kingston, Financial Services and Legal Services). A staff report will be prepared for submission to Council with a recommendation to approve or reject the BFTIP application, together with the draft Tax Assistance Bylaw, where applicable. If the application is approved by Council, City staff will negotiate a Brownfield Site Agreement with the Property Owner or their agent in which the financial elements of the BFTIP may be linked with the components of the Remedial Action Plan and any applicable conditions and/or requirements of any associated planning, building or engineering approvals. If the application is approved,

the Property Owner and their agent will be notified about the start date of the eligibility of costs and the next steps in the process.

6.6.7 Tax Assistance Bylaw

Only one bylaw is required to provide Tax Assistance to an Eligible Property under the BFTIP. If the Bylaw includes matching provincial Tax Assistance for the education portion of the property taxes, the bylaw may be divided into two parts dealing with the specifics of each portion of the tax cancellation. The bylaw will include, but not be limited to, the following:

- the current assessment value and tax levy on the property;

- the anticipated duration of the Assistance Period;

- the obligations of the Property Owner to repay the Tax Assistance in certain prescribed circumstances; and

- an acknowledgement that the City is not becoming a partner in the project and is not assuming any management, care or control of the project by virtue of providing municipal property Tax Assistance (BFTIP).

6.6.8 Tax Cancellation

The cancellation of property taxes commences after Council's approval of the Tax Assistance Bylaw and the execution of the Brownfield Site Agreement and may continue through the Assistance Period, or such other period as stipulated in the bylaw.

6.6.9 BFTIP is Not Retroactive

With the exception of eligible study costs not fully covered by the Initial Study Grant or other sources of funding, the BFTIP funding is not offered retroactively for any Rehabilitation and/or redevelopment activities undertaken, or costs incurred, prior to Council passing the Tax Assistance Bylaw and/or the Property Owner entering into a Brownfield Site Agreement with the City.

6.7 Tax Increment-Based Rehabilitation Grant Program (TIRGP)

6.7.1 Purpose

The purpose of the TIRGP is to encourage private sector Rehabilitation and adaptive reuse of Brownfield Sites by providing an annual grant to help pay for eligible site Rehabilitation costs incurred by the Property Owner that are not fully covered by the BFTIP. The TIRGP is used to fund the Rehabilitation Grant and the Municipal Brownfield Reserve Fund (MBRF).

6.7.2 TIRGP Duration

Except for end dates described within Section 6.0 and below, there are no specified end dates for approval of applications, or the availability of Rehabilitation Grants related to the TIRGP program.

For projects within CIPA 6, applications for the TIRGP will be received until December 31, 2035. Rehabilitation Grants that are approved by Council will continue to be paid after December 31, 2035 , until the approved eligible Rehabilitation costs have been recovered, or until December 31, 2045, whichever occurs first.

For the properties at 51-57 Queen, 18 Queen and 282 Ontario Street, Rehabilitation Grants that are approved by Council will continue to be paid until eligible Costs have been recovered by the property owner, or until December 31, 2041, whichever occurs first.

For projects within CIPA 5, Rehabilitation Grants that are approved by Council will continue to be paid until eligible Rehabilitation Costs have been recovered by the property owner, or until December 31, 2038, whichever occurs first.

6.7.3 Eligible Properties

An eligible property for the TIRGP must be located in a Community Improvement Project Area and must require environmental Rehabilitation and/or risk assessment/management.

6.7.4 TIRGP Requirements

Property Owners and their agents are eligible to apply for funding under the TIRGP, subject to meeting the General Program Requirements set out in Section 6.3 of this CIP, the requirements outlined in this Section 6.7, and the availability of funding as approved by Council. Further details with respect to TIRGP eligibility requirements are contained in the "BFTIP and TIRGP Implementation Guide".

Each property selected to participate in the TIRGP will be eligible for a maximum of one Rehabilitation Grant. In addition, the Eligible Property shall be rehabilitated and developed such that the amount of work undertaken is sufficient, at a minimum, to result in an increase in the assessed value of the property.

6.7.5 TIRGP Description

The Rehabilitation Grant is designed to help Property Owners of Brownfield Sites in the Community Improvement Project Areas offset the majority of the costs of Rehabilitation and redevelopment in order to level the financial playing field between Brownfield Sites and Greenfield Development. The grant is also intended to pay for other brownfield related costs, such as building demolition and the placing of clean fill and grading. The maximum amount of the Rehabilitation Grant is based on the increase between the development taxes and post-development taxes for the property and is calculated by taking the value of the approved eligible Rehabilitation costs and subtracting the Initial Study Grant amount and the municipal and education portions of the Tax Assistance.

The amount of municipal taxes ("Base Rate") will be determined before commencement of the project. The increase in the municipal portion of the property taxes will be calculated as the difference between the Base Rate and the amount of municipal taxes levied as a result of re-evaluation by the Municipal Property Assessment Corporation (MPAC) following project completion and occupancy. The Rehabilitation Grant does not exempt Property Owners from an increase/decrease in municipal taxes due to a general tax rate increase/decrease, or a change in assessment for any other reason. The does not exempt Property Owners from paying the education portion of the property taxes.

The Rehabilitation Grant is paid to the Property Owner on a "pay-as-you-go" basis, i.e., the Property Owner pays for the cost of Rehabilitation and development up-front and pays all property taxes each year. The Property Owner, or assignee, is then reimbursed through an annual grant once the project has been completed, and the first year of post-development taxes have been paid to the City. Unless otherwise stated in this CIP, the annual grant to the Property Owner may equal up to fifty percent (50%) of the pre to post development tax difference (the Tax Increment); and twenty percent (20%) of the Tax Increment will be directed to the Brownfields Reserve Fund (MBRF) to provide for City participation in the Brownfields Redevelopment Strategy (refer to Section 6.9).

The Rehabilitation Grant will lapse if the development has not been started within five years and completed within seven years of the signing of the Brownfield Site For approved projects, the amount of the Rehabilitation Grant will be set out as a maximum amount within a Brownfield Site Agreement. If, during the course of the work, the scope of the work changes, or actual costs are greater or less than the estimated costs, the total amount of the Rehabilitation Grant shall not be increased.

The percentage of pre to post development tax difference available as an annual rebate may be increased above the 50% maximum, up to 80%, for Strategic Projects where:

- A Strategic Project will include the provision of significant community benefits over and above those of environmental remediation and new housing typically provided by other brownfield projects, and

- A Strategic Project will incur additional eligible remediation costs directly related to the delivery of the significant community benefits, and

- The additional eligible remediation costs cannot be expected to be recovered through the 50% rebate over 20 years.

Except for inflationary increases that may be applied at the time an approved project submits their request to start annual rebate payments.

6.7.6 Application Process

Applications will be processed and approved on a first come, first served basis. Property Owners and their agents should pre-consult with the City's Real Estate and Environmental Initiatives Department to confirm TIRGP eligibility. Applications for the TIRGP may be filed concurrently with applications for one or more of the other financial incentive components of the Brownfields Program, as outlined in this CIP, and must include, among other matters:

- A description of the development concept, concept plans, total project construction value, phasing and timing, and a summary of any planning applications that have been submitted and their status;

- A detailed description of the eligible Rehabilitation works to be completed together with a cost estimate for each of the eligible works;

- The current property assessment and an estimate of future assessment based on the development proposal (the estimated post-project assessed value will be used to calculate the estimated annual and total grant, and the estimated duration of grant payments);

- Supporting technical studies and reports including Phase I or II ESA's and/or a SSRA; the Remedial Action Plan; the Rehabilitation approach under consideration (i.e. full-depth, stratified, or risk assessment); the Environmental Monitoring Program; and, any eligible LEED Program cost estimates.

Only complete TIRGP applications will be processed. Further details with respect to the application requirements and process are contained in the "BFTIP And TIRGP Implementation Guide".

Review and evaluation of the TIRGP application and supporting materials against Program eligibility requirements will be undertaken by the Real Estate & Environmental Initiatives Department. The application will be circulated to other City departments for review and comment (e.g. Planning, Building & Licensing Services, Engineering, Utilities Kingston, Financial Services and Legal Services). A staff report will be prepared for Council with a recommendation to approve or reject the TIRGP application together with the draft bylaw to approve financial incentives, where applicable, which will establish the maximum amount of financial incentives and the start date of eligible costs and approval to enter into a Brownfields Site Agreement (refer to Section 6.7.9). The TIRGP Grant Bylaw (refer to Section 6.7.8) will also be presented with this report to Council. The Property Owner and their agent will be notified in writing of Council's decision. If the application is approved, the Brownfields Financial Incentives Bylaw will be given three readings and the TIRGP Grant Bylaw will be given first and second readings only, and the Property Owner and their agent will be notified about the start date for the eligibility of costs and the next steps in the process.

Once the site Rehabilitation works are complete, the Property Owner or their agent files a Record of Site Condition (RSC), as per Ontario Regulation 153/04, with the Ministry of Environment and Climate Change (MOECC) and provides the City with a copy of the MOECC acknowledgement of receipt of the RSC. Once an Occupancy Permit has been issued, the property has been re-assessed by MPAC, and one year of property taxes have been paid, the Property Owner or their agent notifies the Real Estate & Environmental Initiatives Department. Staff will present a report to Council confirming the amount and duration of the Rehabilitation Grant payments and requesting third and final reading of the TIRGP Grant Bylaw.

6.7.7 Brownfield Financial Incentives Bylaw

A Brownfield Financial Incentives Bylaw is prepared for each application to establish maximum amount of financial incentives and the start date of the eligible costs for the project. It is intended that each Brownfield Financial Incentives Bylaw will address the following:

- the property identification;

- the value of the Rehabilitation Grant;

- an acknowledgement that a decision on the Financial Incentives Bylaw will not constrain the City's decisions on any other matter related to the property;

- the Eligibility Date, which is the start date of the eligible Rehabilitation costs; and

- an acknowledgement that the City is not becoming a partner in the project and is not assuming any management, care or control of the project by virtue of providing the financial incentives.

The Brownfield Financial Incentives Bylaw will be given three readings and adopted by Council, provided that Council approves the application.

6.7.8 TIRGP Grant Bylaw

A TIRGP Grant Bylaw is prepared for each TIRGP application in order to establish site-specific financial details of the grant components of the TIRGP to be applied to project. It is intended, in general terms, that each TIRGP Grant Bylaw will, at a minimum, address such matters as the following:

- the property identification;

- the Remedial Action Plan and approved eligible Rehabilitation costs;

- the value of the Rehabilitation grant;

- the value of the TIRGP to be used to deliver the grant monies;

- the detailed duration and schedule of the Rehabilitation Grant payments; and

- an acknowledgement that the City is not becoming a partner in the project and is not assuming any management, care or control of the project by virtue of providing the Rehabilitation Grant (TIRGP).

The TIRGP Grant Bylaw cannot be given third and final reading and adopted by until the property Rehabilitation is complete and the Property Owner has submitted all invoices for the approved eligible Rehabilitation costs and satisfied all other conditions for receipt of the TIRGP grants as set out within a Brownfield Site Agreement.

An inflationary adjustment may be made to the maximum approved eligible remediation costs at the time an approved project submits their request to begin TIRGP rebates and has submitted invoices and auditor's statements if the project:

- has actual remediation costs that are higher than the approved maximum eligible remediation costs, and

- remediation started more than twenty-four (24) months after receiving Council approval for brownfield financial benefits.

Any inflationary increase will be based on the lesser of Consumer Price Index (CPI) or the percent increase in municipal tax assessment for the period of time between project approval and the start of remediation.

6.7.9 Brownfield Site Agreement

The Brownfield Site Agreement must be executed by the Property Owner prior to Council approval of the BFTIP or TIRGP application. The agreement shall be executed by the City upon receipt of Council approval of the BIFTIP or TIRGP application. The agreement shall establish the financial elements of the Brownfields Program and the obligations of the Property Owner and the City. The agreement will be modified, as required, to recognize the uniqueness of each Brownfield Site and the associated environmental constraints and development challenges. The timing of the project, as well as any phasing, or staging, and performance requirements, may also be addressed in the agreement.

Without limiting its generality, the Brownfield Site Agreement may include such matters as the following:

- The term of the agreement;

- Any Development Period phasing and/or timing;

- The Property Owner's representations and obligations;

- Monitoring and audit of eligible Rehabilitation cost details;

- The City's representations and obligations;

- Grant calculation and payment;

- Defaults and remedies and indemnity; and

- An acknowledgement that the City is not becoming a partner in the project and is not assuming any management, care or control of the project by virtue of providing Tax Assistance (BFTIP) or a Rehabilitation Grant (TIRGP) or an Initial Study Grant (ISG).

Once executed by all parties, the Brownfield Site Agreement must be registered against the title of the Eligible Property to which it applies. Approval and execution of the agreement is not a guarantee that funding will be provided. All conditions and obligations, as set out in the agreement, must be complied with by the Property Owner in order to be entitled to the Rehabilitation Grant or any other financial incentives set out within the agreement.

6.7.10 Grant Payments

When the benefits of the Tax Assistance (BFTIP) end, the Rehabilitation Grant (TIRGP) may begin, with a request from the Property Owner, provided that the requirements of the Brownfield Site Agreement have been met and an Occupancy Permit has been issued by the City, reassessment of the property has taken place by the Municipal Property Assessment Corporation (MPAC), and the Property Owner has paid the property taxes in full for the year in which the grant is to be provided. The City may the grant payments for up to 20 years following the effective date for the new assessment, or up to the value of the approved eligible Rehabilitation costs, whichever occurs first. The total value of the Rehabilitation Grant, the BFTIP tax assistance (both municipal and education) and the Initial Study Grant cannot exceed the total value of the approved eligible Rehabilitation costs.

TIRGP grant payments will only begin to be paid in the year that the TIRGP request is made by the owner and the third reading of the TIRGP bylaw has been passed by Council. TIRGP grant payments are not retroactive and previous year's municipal property taxes will not be held by the City and paid out when the TIRGP payments

If a building(s) erected on an Eligible Property is demolished during the Occupancy Period, the remainder of the monies to be paid out under the grant shall be forfeited.

6.7.11 TIRGP Eligible Costs Are Not Retroactive

With the exception of eligible study costs not fully covered by the Initial Study Grant or other sources of funding, the TIRGP funding is not offered retroactively for any Rehabilitation and/or redevelopment activities undertaken, or costs incurred, prior to Council approving the TIRGP application and the Property Owner entering into a Brownfield Site Agreement with the City.

6.8 Municipal Brownfields Reserve Fund (MBRF)

6.8.1 Purpose

The Municipal Brownfield Reserve Fund (MBRF) is intended to facilitate direct City financial involvement in the Rehabilitation and redevelopment of Brownfield Sites in the Community Improvement Project Areas.

6.8.2 MBRF Duration

When the TIRGP ends with the last grant payments paid out possibly as late as December 31, 2035, (December 31, 2045 for projects within CIPA 6) the MBRF may also end. However, if the City wishes to continue the MBRF beyond the life of the TIRGP, it may do so by continuing to direct up to 20% of the tax increment assigned to former Brownfield Sites into the fund, without amendment to the CIP. Alternatively, the City may conclude the MBRF and return any funds remaining in it to general revenue.

6.8.3 MBRF Description

The MBRF will receive 20% of the municipal tax increment that is retained by the City as a result of properties participating in the TIRGP Rehabilitation Grant, and other monies as may be allocated by Council. The MBRF may be included as a component of the City's broader Environmental Reserve Fund. As funds accrue in this account, the City can use these funds to rehabilitate and develop key strategic parcels or publicly held lands in the Community Improvement Project Areas. The MBRF will function as a revolving fund with any surplus monies deposited back into it. Funds in the MBRF will be utilized only for municipal involvement in Brownfield Sites located within the Community Improvement Project Areas.

The Real Estate & Environmental Initiatives Department and Financial Services will administer the MBRF, in consultation with other City departments as necessary. It is intended that the cost of administering the MBRF portion of the Brownfields Program may be drawn, as required, from the fund.

6.9 Tax Arrears Cancellation – Program for Failed Tax Sale Properties

6.9.1 Purpose

The purpose of this program is to stimulate the Rehabilitation and redevelopment of properties in tax arrears by third parties. The program allows the City to cancel the taxes owing on a property after a Failed Tax Sale as an incentive to a potential purchaser to acquire and redevelop the property. The cancellation of property taxes after a failed tax sale is authorized by the Municipal Act, 2001.

6.9.2 Background

In 2004, Council approved a Failed Tax Sale Properties Policy to deal specifically with properties that had gone through the tax sale process and not been sold. The policy was intended to assist in determining whether the City would Vest (take ownership of) the property or how to deal with the property if Vesting was not in the interests of the City. That policy was incorporated into the Brownfields CIP as another implementation strategy to put more potential brownfield redevelopment properties on the market.

The City's strategy for putting Failed Tax Sale properties back into productive use has been successful. Several Failed Tax Sale properties have been acquired by the City for municipal purposes. The City also took a proactive approach to issue requests for proposals for the other Failed Tax Sale properties deemed surplus to City needs whereby, in exchange for a commitment to take ownership, rehabilitate and redevelop the property, the City provided private sector developers with title to the properties, cancellation of back taxes and access to environmental information reports. Where the Failed Tax Sale property was located within one of the Community Improvement Project Areas and identified as being contaminated, the Property Owner was encouraged to apply for one or more of the financial incentive components of the Brownfields Program.

6.9.3 Program Description and Process

The Municipal Act, 2001 authorizes the City to conduct a public sale of properties in tax arrears. The City will, as soon as a property is eligible, place the property up for tax sale to maximize the prospects of a successful sale. Where there is no successful purchaser in response to the public sale, the Act authorizes the City, for a period of 24 months, to enter upon a Failed Tax Sale property for the purpose of inspecting the lands and conducting environmental investigations and testing as deemed necessary. During this period the City can decide if it wishes to exercise the option of taking ownership or deem the property to be surplus to City needs and offer it for sale.

If the decision is made to acquire the property for municipal purposes, the City would undertake the following:

- Identify the proposed use for the property;

- Undertake the appropriate Environmental Site Assessments and/or Risk Assessments to determine the cost of rehabilitating the property (these studies could be funded through the MBRF);

- If the ESAs are acceptable, prepare a report to City Council recommending acquisition of the property for municipal purposes;

- If approved by Council, the City Vests the property and cancels the tax arrears; and

- The property is rehabilitated, if necessary, and then developed for municipal purposes. The cost of site Rehabilitation could be funded through the MBRF.

If the property is deemed to be surplus to City needs, the City would undertake the following:

- Undertake Environmental Site Assessments and/or Risk Assessments to determine the cost of rehabilitating the property (these studies could be funded through the MBRF);

- Determine the market value for the property (the City may requisition an appraisal at this time the cost of which could be funded through the MBRF);

- Initiate a request for proposals (RFP) process. This process will include a requirement that the property must be rehabilitated within five years of City vesting (taking ownership). Responses to the RFP must include the following:

- A description of the proposed redevelopment plan including floor areas, land use, unit breakdown, height, timing and any proposed phasing;

- A Rehabilitation plan that provides an overview of the Rehabilitation approach if a Record of Site Condition (RSC) is required;

- A financial plan that includes proposed purchase price, cost of the redevelopment and detailed estimate of Rehabilitation costs;

- A description of the proposed community benefits (e.g. jobs created, affordable housing units, post-development tax revenue for the City); and

- A description of the proponent's experience, qualifications and understanding of the project;

- Award the RFP to the successful proponent;

- Enter into an Agreement of Purchase, Sale and Redevelopment with the proponent;

- Submit a report to City Council with recommendations to Vest the property, cancel the tax arrears and declare the property to be surplus to City needs;

- The Agreement of Purchase, Sale and Redevelopment with the proponent specifies the proponent's obligations, default provisions, and any other requirements specified by the City. Agreement conditions may include, but not be limited to, the following:

- The proponent agrees to complete all required Environmental Site Assessments or Risk Assessments by Qualified Persons and in accordance with provincial standards;

- The Proponent agrees to carry out site Rehabilitation to permit the filing of a Record of Site Condition and to comply with any Certificate of Property Use issued under the Environmental Protection Act or agrees to carry out an adaptive reuse project on the property in conformity with applicable environmental guidelines;

- The proponent agrees to complete site Rehabilitation within five years of the City Vesting (taking ownership of) the property;

- Transfer title to the property to the proponent.

Prior to finalizing the sale, the potential for funding under the Brownfields Program would be discussed with the proponent. This discussion could be conducted as part of a pre-application consultation where the options for a development proposal could be explored. If the preliminary discussions indicate that the property meets the eligibility criteria outlined in Sections 6.3 through 6.7 of this CIP, the proponent would be encouraged to submit the appropriate application(s).

6.10 Development Charges & Impost Fee Assistance

The City's existing Development Charge and Impost Fee Bylaws include provisions that allow the City to provide exemptions to the charges and fees for properties that are within the designated "Community Improvement Area" as shown on Schedule 10 of the Official Plan and that are subject to an approved Community Improvement Plan.

Although the 2005 Brownfields CIP recognized these exemptions as a complement to the financial incentive components of the Brownfields Program, other than for projects within CIPA 6, such exemptions are not included within the terms of the 2017 Brownfields CIP.

Relief from development charges and impost fees, either in whole or in part, is at the sole discretion of Council. Any charges and fees exemptions previously approved for Brownfield Sites under the 2005 Brownfields CIP, as amended, would still have to be paid into their respective funds. Once the Rehabilitation Grant has been paid to the Property Owner, the tax differential would then continue and be used to pay any development charges and impost fees that were exempted.